Understanding Invoice Factoring

From PLEX Capital

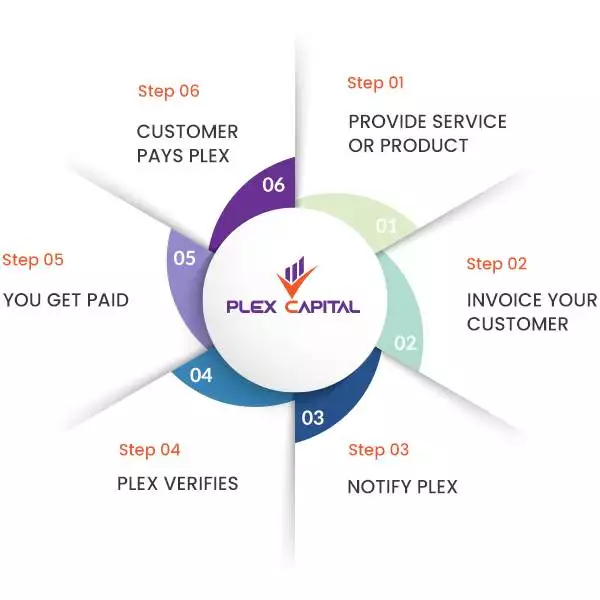

Invoice factoring is a financial arrangement that offers businesses a practical solution to their cash flow challenges. It works by allowing a company to sell its unpaid invoices to a specialized financial institution called a factor. Instead of waiting for customers to settle their invoices, businesses can receive an immediate cash infusion, typically around 70% to 90% of the invoice’s total value, within a day or two of submitting the invoices to the factor. This quick injection of funds can be crucial for covering operational expenses, expanding the business, or seizing new opportunities without taking on additional debt.

One of the key advantages of invoice factoring is that it shifts the responsibility of collecting payments from the business to the factor. The factor assesses the creditworthiness of the business’s customers and assumes the risk of non-payment. Once the customers pay the invoices, the factor deducts its fees and the initial advance, then transfers the remaining balance to the business. Invoice factoring is especially beneficial for businesses with slow-paying customers or those experiencing seasonal fluctuations in cash flow, offering a flexible financing option to help them thrive and grow.

Invoice Factoring Benefits for My Business

Invoice factoring from Plex Capital offers a strategic financial solution for businesses seeking immediate cash flow improvements. By selling outstanding invoices to Plex Capital, businesses can access a significant portion of their accounts receivable upfront, enabling them to:

Improve Cash Flow: Factoring provides quick access to working capital, ensuring that businesses have the liquidity needed to cover expenses, invest in growth, and seize new opportunities.

Enhance Credit Management: Plex Capital assumes responsibility for collecting payments, reducing the administrative burden on businesses and ensuring timely collections.

Mitigate Risk: Factoring helps businesses hedge against potential bad debts by transferring the credit risk to Plex Capital.

Scale Operations: With improved cash flow, businesses can take on larger projects, fulfill orders, and meet operational demands without financial constraints.

Seize Growth Opportunities: Quick access to cash allows businesses to invest in marketing, inventory, and infrastructure, ultimately fostering expansion and success.

In essence, Plex Capital’s invoice factoring empowers businesses to maintain a healthy cash flow, optimize credit management, and accelerate growth—all with a simple, effective, and accessible financial solution.

Client Success Stories from PLEX Capital

Karen Millwood Voche'2022-05-10WholeCare Medical Staffing recognizes that great visionaries rise up, with integrity, to meet a need. Plex Capital does just that. Amanda identifies with the underserved, minority, female, small business owner and embraces our unique challenges. Josh welcomed us with the promise of great service and they have delivered. Kayla provides exceptional support with patience, thoughtfulness, clarity and professionalism in a timely manner. Thanks to Plex Capital our future is secure and we can focus on building tremendous success.

Karen Millwood Voche'2022-05-10WholeCare Medical Staffing recognizes that great visionaries rise up, with integrity, to meet a need. Plex Capital does just that. Amanda identifies with the underserved, minority, female, small business owner and embraces our unique challenges. Josh welcomed us with the promise of great service and they have delivered. Kayla provides exceptional support with patience, thoughtfulness, clarity and professionalism in a timely manner. Thanks to Plex Capital our future is secure and we can focus on building tremendous success. Briana Jackson2022-05-02Plex capital is absolutely wonderful! The customer support and service is top tier. My rep Meghan always answers my questions and concerns in a timely manner more often almost immediately. Meghan is very attentive to my needs and concerns and I appreciate that because I'm sure she works with a million other clients but I would never know because she handles her business! Plex has been a blessing in aiding me with the expansion of my company. I could not have chosen a better company to work with. Best decision I've made thus far for my business. I can assure you PLEX will get the job done!

Briana Jackson2022-05-02Plex capital is absolutely wonderful! The customer support and service is top tier. My rep Meghan always answers my questions and concerns in a timely manner more often almost immediately. Meghan is very attentive to my needs and concerns and I appreciate that because I'm sure she works with a million other clients but I would never know because she handles her business! Plex has been a blessing in aiding me with the expansion of my company. I could not have chosen a better company to work with. Best decision I've made thus far for my business. I can assure you PLEX will get the job done! emily heller2022-04-28I love the training Plex Capital, LLC has provided, both by training meetings and phone support. Its been wonderful! I need step by step and their process provides that. Great Experience!!

emily heller2022-04-28I love the training Plex Capital, LLC has provided, both by training meetings and phone support. Its been wonderful! I need step by step and their process provides that. Great Experience!! sabrina sanders2022-04-27Stephanie has always provided the absolute best customer service. Very professional, eager to help with all situations. Thanks Plex Capital for keeping my business up and running!

sabrina sanders2022-04-27Stephanie has always provided the absolute best customer service. Very professional, eager to help with all situations. Thanks Plex Capital for keeping my business up and running! Cony Garcia2022-04-27Definitely a serious and dedicated company to help your business to grow, solve your funding problems for our businesses. Personally they have become my engine of my company! we love you Plex capital!

Cony Garcia2022-04-27Definitely a serious and dedicated company to help your business to grow, solve your funding problems for our businesses. Personally they have become my engine of my company! we love you Plex capital! Essential Healthcare Staffing LLC2022-04-21This company has brought light and hope to my small business! Amanda has been so patient and informative in my options but most importantly HONEST! Kayla has helped me tremendously with any questions I had. Very honored to be a client here :)

Essential Healthcare Staffing LLC2022-04-21This company has brought light and hope to my small business! Amanda has been so patient and informative in my options but most importantly HONEST! Kayla has helped me tremendously with any questions I had. Very honored to be a client here :) Yolanda Jones2022-02-24I can't say enough great things about Plex Capital, this company operates in the spirit of excellence. I interact with Kayla often and she is responsive, professional and always will have an answer regarding any questions I have. Amanda, Josh, and Rick are also available whenever needed and very responsive to my questions. I can't say enough great things about Plex. I definitely recommend for any new or established business.

Yolanda Jones2022-02-24I can't say enough great things about Plex Capital, this company operates in the spirit of excellence. I interact with Kayla often and she is responsive, professional and always will have an answer regarding any questions I have. Amanda, Josh, and Rick are also available whenever needed and very responsive to my questions. I can't say enough great things about Plex. I definitely recommend for any new or established business. Joseph Nyagah2022-02-03I highly recommend Plex Capital - Kayla, Josh and Amanda are awesome, we truly appreciate you and everything that you do.

Joseph Nyagah2022-02-03I highly recommend Plex Capital - Kayla, Josh and Amanda are awesome, we truly appreciate you and everything that you do. Acute Medical Staff2022-02-03What a great company. Excellent customer service! Plex Capital is more than a funding company, they are a true business partner which feels like family. Given the day to day demand of the medical staffing industry very little time remains for administrative tasks. Their support allows us to focus on providing the best service to our clients. Partnering with Plex has helped us to be a top competitor in the medical staffing industry. Amanda and Josh are amazing.

Acute Medical Staff2022-02-03What a great company. Excellent customer service! Plex Capital is more than a funding company, they are a true business partner which feels like family. Given the day to day demand of the medical staffing industry very little time remains for administrative tasks. Their support allows us to focus on providing the best service to our clients. Partnering with Plex has helped us to be a top competitor in the medical staffing industry. Amanda and Josh are amazing. JRAYtheOG2022-02-03Plex is AMAZING!!!!! Their communication, understanding, and quick response when we are in a crisis is definitely impressive. I would forever recommend Plex to anyone! ~Elite Medical Staffing- Fort Wayne

JRAYtheOG2022-02-03Plex is AMAZING!!!!! Their communication, understanding, and quick response when we are in a crisis is definitely impressive. I would forever recommend Plex to anyone! ~Elite Medical Staffing- Fort Wayne

How Did Invoice Factoring Become So Useful Today?

Invoice factoring has become increasingly useful in today’s business landscape due to several key factors:

Cash Flow Challenges: In a competitive market, businesses often experience cash flow gaps due to delayed customer payments. Invoice factoring offers a reliable solution to address these challenges by providing immediate access to a significant portion of the invoice amount.

Simplified Access to Financing: Traditional bank loans can be time-consuming and challenging to secure, especially for small and medium-sized businesses. Invoice factoring provides a quicker and more accessible source of financing without the need for extensive credit checks or collateral.

No New Debt: Invoice factoring is not a loan; it’s a sale of accounts receivable. Businesses can access working capital without accumulating debt, making it a more attractive option for those looking to maintain a healthy balance sheet.

Boosting Growth: Factoring allows businesses to invest in growth opportunities, such as taking on larger contracts, expanding operations, or launching new product lines. The improved cash flow facilitates business development.

Flexible Funding: Factoring grows with a business. As a company generates more invoices, it can access more funding through factoring, providing scalability to meet changing financial needs.

Risk Management: Factoring companies often assume the risk of customer non-payment, providing businesses with a level of security against bad debts.

Outsourcing Collections: Factoring companies handle collections on behalf of businesses. This saves time and resources, allowing companies to focus on core operations.

Diverse Business Applications: Invoice factoring is not limited to specific industries. Businesses in various sectors, including manufacturing, construction, staffing, healthcare, and more, use factoring to address cash flow challenges.

Operational Efficiency: Improved cash flow enhances a business’s ability to meet immediate financial obligations, such as paying employees, purchasing inventory, or covering operational costs. This leads to smoother and more efficient business operations.

Client Relationships: Factoring companies typically maintain professionalism in collecting payments from customers, preserving the positive relationships between businesses and their clients.

Globalization: As businesses increasingly engage in international trade, invoice factoring can help bridge the gaps in payment schedules between international clients and suppliers.

Technology and Automation: Advances in technology have streamlined the factoring process, making it more efficient and user-friendly for both businesses and factoring companies.

In today’s fast-paced business environment, the ability to access working capital quickly and efficiently is essential. Invoice factoring has evolved to meet these needs, making it a valuable tool for businesses of all sizes, particularly for addressing cash flow challenges and promoting growth.

Examples of Invoice Factoring Usages

Business: XYZ Manufacturing, a mid-sized manufacturing company that specializes in custom metal fabrication for various industries.

Scenario: XYZ Manufacturing was experiencing a common challenge in the manufacturing industry: cash flow fluctuations due to extended payment terms with their customers. Many of their clients, including large construction companies and industrial suppliers, paid their invoices on a net-60 or net-90 basis.

This delay in receiving payments was straining XYZ Manufacturing’s cash flow and hindering their ability to purchase raw materials, pay employees, and fulfill new orders promptly. They knew that missing out on potential contracts or delaying production due to financial constraints was detrimental to their growth and reputation.

In this scenario, XYZ Manufacturing decided to explore invoice factoring as a solution to their cash flow challenges. They partnered with a reputable factoring company, which offered the following benefits:

Immediate Cash Infusion: Upon delivering completed orders and generating invoices, XYZ Manufacturing sold their invoices to the factoring company. This allowed them to receive a significant portion of the invoice value upfront, typically within 24 hours.

Working Capital Flexibility: The cash received from factoring gave XYZ Manufacturing the flexibility to manage their day-to-day operations with ease. They could purchase materials, pay employees, and meet production demands without delay.

Growth Opportunities: With improved cash flow, XYZ Manufacturing was able to capitalize on growth opportunities. They could confidently take on larger projects and secure contracts with bigger clients.

Steady Business Operations: The factoring company handled collections on the invoices, relieving XYZ Manufacturing of the administrative burden and ensuring timely payments from their customers.

No New Debt: Unlike traditional loans, invoice factoring didn’t create debt for XYZ Manufacturing. They simply leveraged their outstanding accounts receivable to access the working capital they needed.

As a result, XYZ Manufacturing not only improved their cash flow and financial stability but also positioned themselves as a reliable and competitive player in their industry. Invoice factoring became an invaluable financial tool that helped them navigate the challenges of extended payment terms and seize growth opportunities with confidence.

Business: ABC Staffing, a successful staffing agency specializing in providing temporary and permanent personnel to a wide range of industries.

Scenario: ABC Staffing had built a strong reputation in the staffing industry, serving businesses across various sectors, from healthcare to IT. They had a steady flow of clients and a reliable roster of candidates. However, they encountered a common challenge in the staffing industry: inconsistent cash flow due to the timing of client payments.

The staffing agency had to cover salaries and operational costs promptly, but many of their clients operated on net-30 or even net-45 payment terms. This discrepancy between paying employees and waiting for client payments caused cash flow gaps and made it challenging for ABC Staffing to operate smoothly.

In response to these cash flow challenges, ABC Staffing decided to explore invoice factoring as a solution. They partnered with a reputable factoring company, which provided the following benefits:

Immediate Cash Injection: After successfully placing candidates and generating invoices for their clients, ABC Staffing sold these invoices to the factoring company. In return, they received an immediate advance, usually around 90% of the invoice value.

Timely Salary Payments: The cash received through factoring allowed ABC Staffing to pay their employees on time, maintaining high morale and retention among their candidates.

Growth and Expansion: With improved cash flow, ABC Staffing had the financial freedom to expand their operations. They could take on larger contracts and serve more clients.

Client Relationships: The factoring company handled the collection process on behalf of ABC Staffing. This ensured that their client relationships remained strong, as clients continued to receive reliable service and timely invoices.

Flexible Funding: Factoring provided a flexible funding solution that grew alongside ABC Staffing’s business. The more invoices they generated, the more cash they could access through factoring.

By leveraging invoice factoring, ABC Staffing addressed their cash flow challenges without taking on additional debt. They not only improved their financial stability but also positioned themselves for sustained growth and a competitive edge in the staffing industry.

Business: JKL Construction, a mid-sized construction company specializing in residential and commercial projects.

Scenario: JKL Construction was thriving in a competitive construction industry, winning contracts for various projects, from building new homes to renovating commercial properties. However, they faced a common issue in the construction sector: extended payment terms.

Most of their clients, including property developers and businesses, operated on net-60 or net-90 payment schedules.

As a result, JKL Construction often had to wait months to receive payments for completed projects. This cash flow gap strained their ability to pay subcontractors, purchase materials, and cover operational costs, leading to delays and occasional missed opportunities.

In response to these cash flow challenges, JKL Construction turned to invoice factoring as a solution. They partnered with a reputable factoring company, which offered the following benefits:

Immediate Cash Relief: After completing construction projects and generating invoices, JKL Construction sold these invoices to the factoring company. In return, they received an advance, usually around 85% of the invoice value, within a day.

Timely Payments to Subcontractors: With improved cash flow, JKL Construction could pay subcontractors promptly, ensuring a reliable workforce and strong subcontractor relationships.

Material and Equipment Purchases: The cash from factoring allowed JKL Construction to purchase materials, tools, and equipment when needed, preventing delays in project timelines.

Scaling Operations: The construction company could confidently take on larger projects and seize new opportunities with the steady cash flow provided by factoring.

Administrative Ease: The factoring company took on the responsibility of collecting payments from clients. This relieved JKL Construction of administrative tasks and ensured timely payment collections.

By utilizing invoice factoring, JKL Construction addressed cash flow challenges without incurring debt. It not only improved their financial stability but also positioned them as a reliable and competitive player in the construction industry, ultimately fostering growth and a strong reputation.

Would Plex Capital Be Beneficial to Your Business?

From healthcare staffing to abatement services, we work behind the scenes in many industries to provide payroll funding for determined entrepreneurs.

Our team is passionate about helping ignored communities attain the American dream by funding the future of their businesses. Our goal is to create an unstoppable domino effect where women, minorities and ignored communities become role models for future generations. Let’s make success happen, together.

Staffing Services

Our team takes pride in our ability to quickly fund a wide variety of staffing agencies, no matter the industry. We specialize in providing payroll funding for several staffing agencies, including:

- Healthcare Staffing

- Light Industrial Staffing such as:

- Informational Technology (IT) Staffing

- Medical Staffing

- Security Guards Staffing

- General Staffing

- Engineering Staffing

- Administrative Staffing

- Professional / Managerial Staffing

- Government Contracting

Construction

We understand that getting paid for construction jobs can take time. Even if your clients pay you in 30, 60, or 90 days, you still need to pay your employees and equipment leases on time. PLEX Capital offers payroll funding to help you grow your business and pay your employees when it’s most important.

We proudly help construction companies fund and expand their business through payroll funding. We specialize in providing payroll funding for several construction industries, including:

- Underground Construction

- Abatement Services

- Masonry Construction

- Handiwork Services

- Heating & Cooling

- Roofing Services

Other Industries

We know that entrepreneurs come in many forms, with many different businesses and backgrounds. That’s why we are happy to provide payroll funding to businesses of all shapes and sizes, no matter the industry. If you are a service provider in the B2B space, feel free to contact us today for a free consultation. Let’s fund and expand your business, together.

We are proud to help determined dreamers support their business endeavors through payroll funding. We specialize in providing payroll funding for companies of all kinds, including:

- Janitorial Cleaning ServicesLogistics and

- TransportationAbatement Service Companies

- Underground Utilities Companies

- Mitigation Companies

- Manufacturing & Fabrication

Empowering Business Growth: The Transformational Influence of Invoice Factoring Companies

Unleashing Potential in Healthcare Staffing with Reliable Payroll Solutions

PLEX Capital: Empowering Healthcare Staffing with Payroll Funding

- Upload your invoices to your PLEX Portal.

- Funds go directly into your business account.